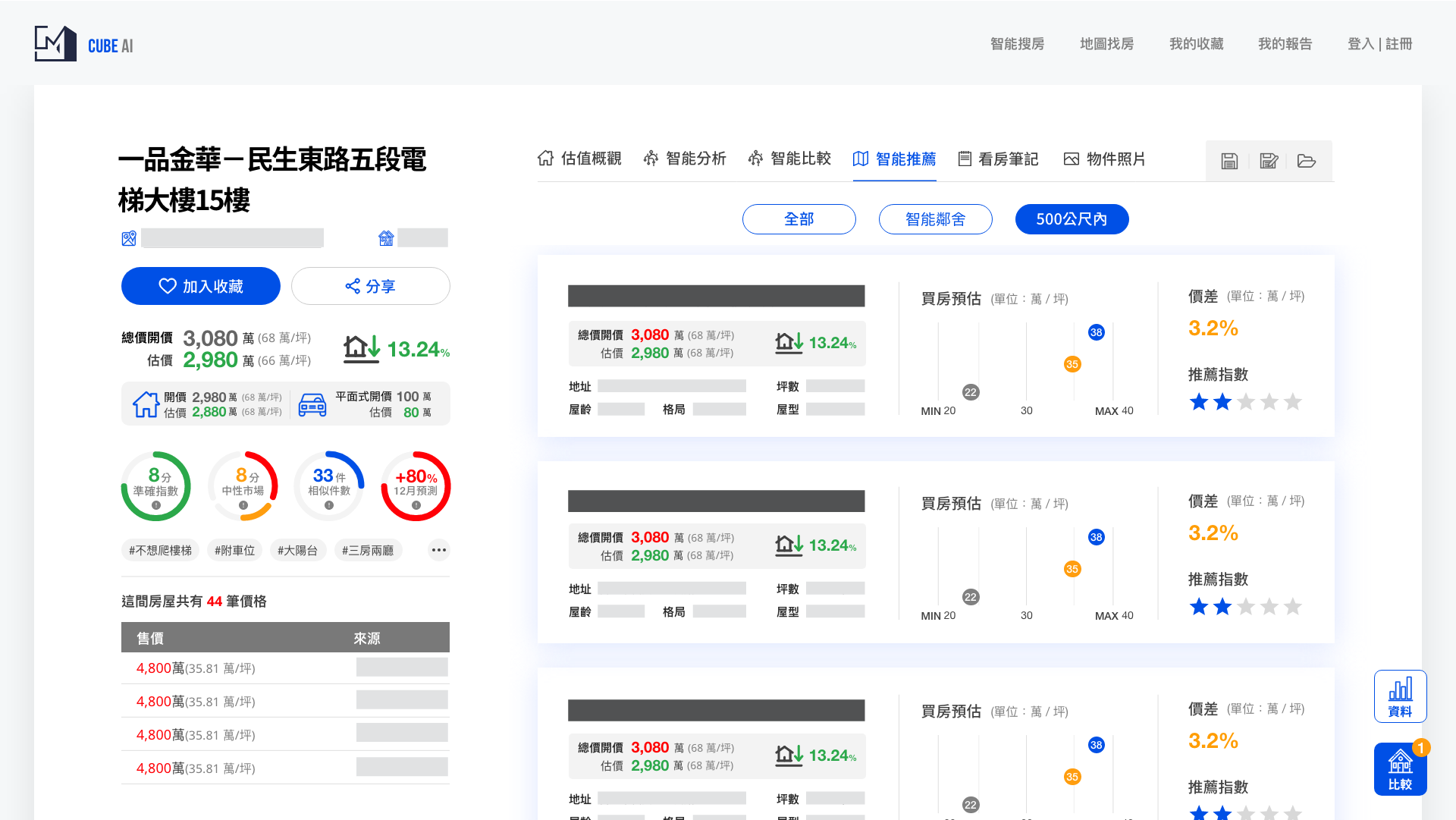

我們提供

未來的房地產投資解決方案

我們提供全新、簡潔且精準的房地產投資方式,令投資表現更可預測, 行動更加便捷且快速。

處理

資產

US$

16,500,000資產估值

75,000

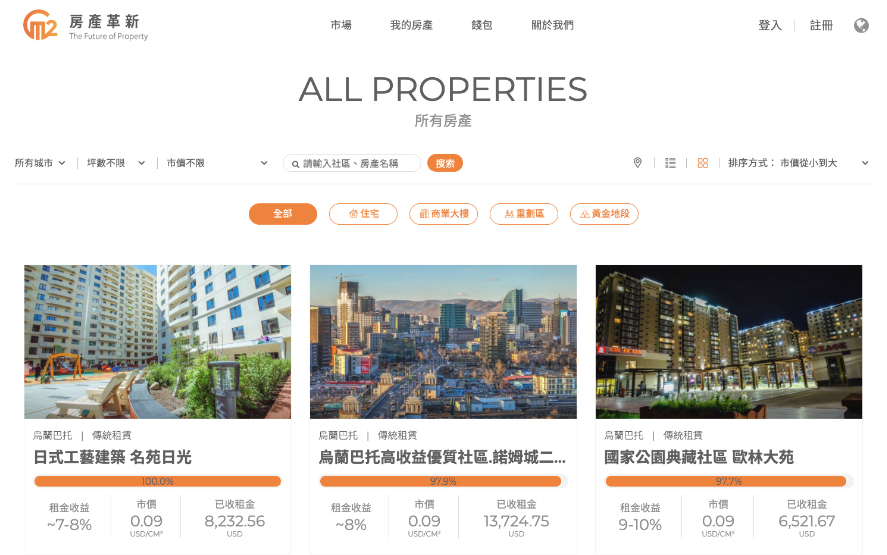

投資新方式的成功案例

台灣商業辦公室投資

提升收益、優化現金流、投資流程自動化

J&E 國際物業顧問

用務實完整的分析報告吸引客戶

資深房產投資者

如同銀行一般的全方位盡職調查

為何我們與眾不同?

我們主張的 3A 價值

準確性就是收益極大化

Accurate

我們獨門的AI技術可提供您亞洲最準確的估值結果。對用戶而言,這將是您的製勝法寶。

比您的競爭對手更迅速

由於需要評估和管理許多參數,因此極為考驗速度。我們的解決方案可幫助您快又精準地採取行動。

自動化您的業務、管理流程

Automate

通過機器人流程自動化管理所有權、現金、合約和資產歷史記錄,使您擺脫重複工作,專注於更多的業務開發。

與 CM2 聯絡取得更多信息

了解使用行業領先的 CM2 房地產投資解決方案可以到做什麼

聯繫我們